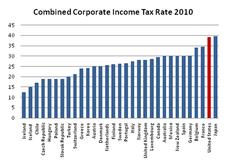

The U.S. has some of the highest corporate income tax rates in the world; the average combined federal and state corporate tax rate is 39.3 percent, rivaled only by Japan. As the U.S. has become a comparatively less profitable place for businesses to locate, the U.S. government and the citizens it serves are losing out on jobs and revenue. According to the Congressional Budget Office (CBO), “Domestic workers are more likely to bear a burden because workers cannot move readily between countries. Domestic wages will fall when capital is reallocated abroad and domestic workers cannot move to take advantage of a higher foreign wage rate.” While it is true that the wealthiest quintile of income earners is liable for the greatest amount of corporate taxes, the corporate tax burden still falls upon the greater population through lower wages and stunted economic growth. Furthermore, the year 2011 will bring about the largest tax hike in U.S. history, affecting all income quintiles if Congress does not act.