Initially proposed by President Obama as stimulus spending targeted at small business investment, the Small Business Jobs and Credit Act of 2010 contains $30 billion in funding to encourage small business lending and $12 billion of small business tax breaks (including a 50% bonus depreciation extension for business capital purchases in excess of the deduction limit in 2010). From taxable year 2010 through the end of 2011,[i] the law will allow businesses to write off all qualifying new investments in plants and equipment in the first year of purchase, rather than over the regular depreciation schedules which typically range from three to 20 years.

What changed for 2010 and 2011?

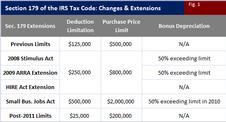

The ability to write off the full purchase price of new qualifying investments has been available to small- and medium-sized businesses for years via a part of the tax code known as Section 179. While the Obama Administration is touting this as a new concept,[ii] the recently enacted law has simply expanded the number of businesses that qualify for the existing full purchase write-off and the types of purchases that qualify for the write-off (now including real property such as leaseholds, restaurants, and retail improvement property). It has also increased the value eligible for write-off as well as the threshold beyond which the exclusion is phased out (see Figure 1).[iii] The Joint Committee on Taxation estimates that this small change in Section 179 will cost $2.2 billion over the next 10 years, and the one-year bonus depreciation extension will cost $5.5 billion.[iv][v] Due to other changes in tax law—including increased tax penalties and the closing of suspected loopholes to raise corporate tax revenues—the bill is estimated to be deficit neutral. The changes designed to raise corporate tax revenues have drawn scrutiny as a result of possible detrimental effects on business investment.[vi]

Will these business incentives stimulate investment?

Expensing merely accelerates the process by which businesses take advantage of deductions. Its value is primarily a function of inflation: expensing allows businesses to take the full deduction in the year of purchase rather than spreading it across a series of future years in which the value of that deduction declines due to inflation.

For the recently enacted expensing incentive to be beneficial, businesses must (1) have a need for new equipment, which requires demand for their output, (2) believe that interest rates will increase in the future (which would make the additional cash-flow gained today through the write-off more valuable), and (3) anticipate taxes will remain the same or decrease in the future (if taxes increase, a future stream of deductions via a regular depreciation schedule may be more valuable than a write-off today).

Stalled economic growth, increased savings, and mounting uncertainty about future taxes, employment, and growth have contributed to weak demand. Without sufficient demand for goods and services, businesses are unlikely to invest in new equipment and property that cannot be put to use. This uncertainty is evident in the fact that, as of the end of the second quarter of 2010, nonfarm and nonfinancial corporate businesses were sitting on $1.85 trillion in liquid assets. This rise in liquid assets (up from $1.56 trillion a year prior) can be largely attributed to businesses’ uncertainty about the direction of the economy and how impending tax law changes will affect them.[vii]

With interest rates already low and the Fed’s recent statement that inflation is below what is consistent with its mandate to promote maximum employment and price stability, the value of the investment expensing option is diminished. As economist Greg Mankiw explains, the expensing policy can be viewed as a zero-interest loan for businesses investing in plants and equipment, but with interest rates already near zero, the benefit is marginal if not insignificant.[viii] Furthermore, Mankiw points out that even though businesses can already borrow at near-zero interest rates to pay for new investments and equipment, they are not doing so (see Figure 2). [ix]

And even absent current conditions, analyses of past temporary partial expensing and bonus depreciation laws indicate that these provisions have had little impact, if any, on business expenditures and investment. [x][xi]

If businesses expect taxes to increase in the future, they will be wary of taking the write-off before those tax increases go into effect because higher tax rates make deductions more valuable. For example, a $10,000 write off in 2010 at a top marginal rate of 35% is worth $3,500 in 2010 dollars, but deducting $10,000 over an ordinary depreciation schedule of five years beginning in 2011 at a top marginal tax rate of 39.6% is worth $3,750, or $250 more, in 2010 dollars. And finally, if a business currently pays no taxes due to losses in business income, the special deduction is essentially worthless and will not cause the business to increase investment.[xii]

The uncertainty surrounding potential benefits of the recently passed write-off provision suggests that the impact on the economy will be relatively small. Even for businesses that find the provision advantageous, the benefit of a one-time write-off is likely to pale in comparison to the loss of business income caused by the expiration of the 2001 and 2003 tax cuts.[xiii] Extending these tax cuts would provide businesses with certainty in their investment decisions and would provide additional income for businesses to hire more employees and expand operations.

Are businesses better off with the

extension of the 2001 and 2003 tax cuts or the extension of write-offs?

According to a recent

report done by the Tax Foundation, 39% of Obama’s proposed $629 billion tax

increase on high-income taxpayers over the next ten years would originate from business

income. This means that an additional

$246 billion will be extracted from small- and medium-sized businesses over the

next 10 years—this is $246 billion that will taken away from investment, job

growth, and business owners’ and employees’ incomes.[xiv]

Additionally, the study finds that while filers making more than $200,000 in

adjusted gross income account for 68% of business income, nearly a third of

that (20% of all business income) is from earners making between $200,000 and

$500,000 (see Figure 3). These earners

are not the “super rich” millionaires singled-out in speeches by President

Obama.

The Administration has defended itself from the criticism that allowing the upper income tax rates to rise will harm small business by hyping the recently passed small business stimulus package as a means to overcome future tax increases. According to Austan Goolsbee, the President’s top economist:

Making the R&D tax cuts permanent and a series of other things that, combined, are more pro growth, are far more business friendly and encouraging of economic activity than would be replacing those things with the tax cuts for the millionaires and billionaires on the top two percent of income.[xv]

The tax cuts to which Goolsbee refers would affect individuals who make over $200,000 per year and couples who make over $250,000. These thresholds are more than a few dollars short of “millionaire” or “billionaire” status. And as for the claim that the recently enacted small business measures are a way to offset upcoming tax increases on the so-called “rich” that will be borne by small businesses, extending the 2001 and 2003 tax cuts would be of dramatically greater value to most businesses than one-time, inferior, targeted measures such as the write-off provisions and increased loan availability. One-time, temporary provisions or tax changes do not cause businesses to make decisions that have permanent effects such as hiring new employees. Rather, businesses respond to the overall tax and economic climate when making lasting and sustainable decisions. As a small business owner in Massachusetts put it in a Wall Street Journal letter to the editor on August 31, 2010:

There is a complete misunderstanding of just how small business actually functions. No small business “creates" jobs simply because it can get a loan at a low rate. Small businesses simply fill positions as needed if it contributes to the development and greater profit of the enterprise.[xvi]

Amidst a faltering economy, the tendency has been to continue temporary and targeted stimulus measures—to the tune of more than $1 trillion—so far. But absent proven success of past stimulus and amidst high unemployment and anemic economic growth, it has become clear that temporary and targeted measures will not jumpstart the economy. Targeting tax cuts in the form of write-offs, credits, and the like negatively affects economic efficiency through resource misallocation, perverse incentives, and added administrative costs. Far more important and effective than tax credits that simply shift spending forward are policies that foster sustainable patterns of employment and economic growth. Though the magnitude of the benefits resulting from tax cuts is disputed, economists unanimously agree that reductions in marginal tax rates fuel economic growth.[xvii] As avowed by the Massachusetts small business owner quoted above:

Taxes are oppressive and strangling the U.S. economy. Tax credits and other tax gimmicks can't have the dynamic impact of an across-the-board tax reduction. Irrational government spending goes hand in hand with the need for more and more taxation. ..If the government really wants a turnaround in the economy, it will find no better solution than lowering taxes and getting off the backs of all businessmen. There are many Bill Gateses and Warren Buffetts out there who are still in their "garage" phase of operation and need only the right government attitude to allow them to blossom in this, the greatest country in the world.

Certainty and low tax rates are necessary to provide businesses with the pro-growth foundation necessary to start hiring and expanding.

[i] Though the bill was announced by President Obama on September 8 and signed into law on September 27, 2010, it will apply retroactively to all purchases in 2010 prior to the law as well.

[ii] Any businesses whose qualifying financing and purchases of business equipment are less than $2,000,000 during 2010 are likely qualified for the Section 179 Deduction. Because the phase out of the write off for purchased equipment exceeding $2 million is dollar-for-dollar, the focus of the law is intended for businesses that make purchases at or under that threshold. In some special cases, the thresholds may be increased due to the geographic location of a business, including the New York Liberty Zone, Enterprise Zone and Renewal Community Businesses, or the Gulf Opportunity Zone (inclusive of areas affected by recent Gulf hurricanes).

[iii] The phase out is such that if the total cost of equipment qualifying as section 179 property exceeds $2 million in 2010 or 2011, the $500,000 write-off allowance is reduced dollar for dollar by the excess of the equipment cost over $2 million. Additionally, the 50% bonus depreciation for qualifying purchases above the $2 million limit will not be renewed for tax year 2011. For more information, see “Section 179 FAQs,” http://www.section179.org/section_179_faqs.html

[iv] ESTIMATED BUDGET EFFECTS OF THE REVENUE PROVISIONS CONTAINED IN SENATE AMENDMENT #4594 TO H.R. 5297, THE "SMALL BUSINESS JOBS ACT OF 2010," JCX-48-10, Joint Committee on Taxation, September 16, 2010, http://www.jct.gov/publications.html?id=3708

[v] “Summary of the Small Business Jobs Act,” H.R.5297: Small Business Jobs Act, U.S. Senate Committee on Finance, http://finance.senate.gov/legislation/details/?id=da799068-5056-a032-5229-92cebbd2b7a0

[vi] Dana Mattioli and James R. Hagerty, “Businesses See Benefits of Tax Break as Limited,” The Wall Street Journal, September 8, 2010, http://online.wsj.com/article/SB10001424052748703720004575478002949942796.html

[vii] The rise in liquid assets can also be measured as the ratio of liquid assets to short-term liabilities. This ratio was most recently at 49.8% at the end of the 2nd quarter of 2010, compared to 42.2% at the end of the 2nd quarter of 2009 and to a twenty-year average ratio of roughly 38.6%. For more information, see “Flow of Funds Accounts of the United States,” Federal Reserve Statistical Release Z.1, Table L.102. http://www.federalreserve.gov/releases/z1/Current/z1r-4.pdf

[viii] Greg Mankiw, “A Small Step in the Right Direction,” Greg Mankiw’s Blog, September 7, 2010, http://gregmankiw.blogspot.com/2010/09/small-step-in-right-direction.html

[ix] Jonathan Weisman and John D. McKinnon, “Obama to Push Tax Break,” The Wall Street Journal, September 7, 2010, http://online.wsj.com/article/SB20001424052748704392104575475920686869934.html

[x] Catherine Rampell, “Reactions to Obama’s Business Tax Write-Off Proposals,” The New York Times, September 7, 2010, http://economix.blogs.nytimes.com/2010/09/07/reactions-to-obamas-business-tax-write-off-proposals/

[xi] Darrel Cohen and Jason Cummins, “A Retrospective Evaluation of the Effects of Temporary Partial Expensing,” Finance and Economics Discussion Series, Divisions of Research & Statistics and Monetary Affairs, Federal Reserve Board, Washington, D.C., 2006, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=910904

[xii] Mark Mansfield, “Why Obama’s Capital Investment Write-Off Will Do Little,” Seeking Alpha, September 14, 2010, http://seekingalpha.com/article/225033-why-obama-s-capital-investment-write-off-will-do-little

[xiii] Calculations based on JCT’s report on H.R. 5297 and Tax Foundation’s findings on business income.

[xiv] Scott A. Hodge, “Over One-Third of New Tax Revenue Would Come from Business Income If High-Income Personal Tax Cuts Expire,” Report No. 185, Tax Foundation, September 2010, http://www.taxfoundation.org/files/sr185.pdf

[xv] Transcript, Austan Goolsbee, “White House’s Austan Goolsbee Talks Taxes on Bloomberg TV,” September 14, 2010, by Carol Massar and Matt Miller, Bloomberg News. http://findarticles.com/p/news-articles/analyst-wire/mi_8077/is_20100914/white-houses-austan-goolsbee-talks/ai_n55247613/

[xvi] Paul C. Ryan, “We Want to Be Optimistic, but That’s Hard Just Now,” Letter. The Wall Street Journal, August 31, 2010, http://online.wsj.com/article/SB10001424052748703959704575453994069839192.html

[xvii] “The Inefficiency of Targeted Tax Policies,” Joint Economic Committee Report, April 1997, http://www.house.gov/jec/fiscal/tx-grwth/targets.htm